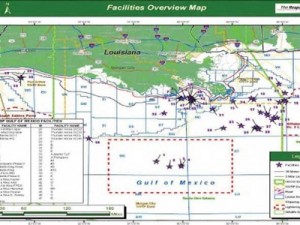

The tourism industry in the Gulf Coast states is coming under pressure as the oil spill continues to expand its coverage area. Consumers are understandably reluctant to go forward with their vacation plans owing to concerns that oil slicks may effectively close the beaches. In Florida and Alabama, vacation resorts are changing their cancellation policies and offering oil-free beach guarantees, by which guests who see oil on the beaches may claim full refunds for their stay. It is similar in concept to the sunny day guarantee, whereby hotels comp guests when rain or inclement weather interferes with their plans. The Resort Collection of Panama City Beach proclaims on its Facebook page “The only oil on our beach is suntan oil!” The tourism in Louisiana is harder hit, as vacationers to that state don’t typically relax on the beach, they engage in activities such as sport fishing, which take them into deeper waters. Recreational fishing is closed for the moment. The hotels are occupied, not with tourists, but with recovery workers and journalists who are there because of the oil spill. Most of our tourism industry is in the small business sector, with individually owned, managed or franchised hotels, restaurants and tour operators. No doubt these businesses were under pressure to begin with as the recession is crimping consumer spending. On top of the economic disaster, the oil spill is another blow.

Archive for May, 2010

Oil-Free Beach Guarantees Stem Losses for Gulf Coast Tourism

Sunday, May 30th, 2010White House Briefing for Small Businesses

Saturday, May 29th, 2010This weekend concludes National Small Business Week, a tradition that began with President John F. Kennedy in 1963. I had the pleasure of spending part of the week in Washington DC, participating in events organized by the National Small Business Association, which recognized me as one of five finalists for the honor of small business advocate of the year. The White House organized a policy briefing for us; I have attached the agenda in the image graphic. For me the highlight of the briefing was the presentation by Gene Sperling, Counselor to the Secretary of the Treasury. He highlighted the four components of the Administration’s small business legislation package that he expects Congress to pass by the Fourth of July. He shared two concerns about the state of small businesses that particularly resonated with me. First, the National Federation of Independent Business publishes an index of small business optimism, reflecting the expectations and views business owners have about the state of the economy. We also have a “CEO Outlook” index, the Fortune-500 equivalent, that captures the big business view of the economy. These two indices should be the same, reflecting the same economy, but in fact there is a wide divergence in views and expectations. Small business and big business are having completely unrelated experiences in our current market which conditions their hopes for the future. The second, and related point, concerns the contraction in bank credit. Large corporations finance only 30% of their capital needs through banks; the comparable figure for small businesses is 90%. So when banks contract their lending, small businesses are more severely impacted. In future blog postings, I will write in greater detail about the issues discussed at this policy briefing and invite your comments. I will tell you that it was 99 degrees outside when we were in Washington DC and despite the stifling heat and humidity, I am very glad that I participated. We had a number of events for several hundred small business owners across the country to come together and work on policy issues of common concern. As difficult as the economy is right now, it is truly inspiring to be engaged in the small business community.

Preliminary Lessons in Crisis Management

Friday, May 28th, 2010The news from the Gulf Coast continues to alarm. The Associated Press reported workers’ accounts of the unfolding tragedy on the Deepwater Horizon drilling rig in the Gulf Coast. Imagine the horror the workers experienced as they attempted to walk across a bloody platform and remove debris from their colleagues’ bodies to see if they were alive and if they could be transported to the lifeboats. It is painful to read, but necessary. The report suggests certain preliminary lessons from the tragedy: first, management was clearly wearing rose-tinted glasses when they did their scenario planning, completely failing to envision a realistic disaster scenario. Second, BP failed to delegate authority to workers for immediate corrective action, resulting in costly delays as critical decisions went up and down the chain of command. Third, management put human safety below procedural formalities, preferring to do roll calls when an immediate evacuation was called for. Fourth, it does not appear that critical safety equipment was regularly tested to ensure its functionality. Fifth, the workers were improperly trained in life-saving procedures. One operator, for example, didn’t know how to detach the life boat from the rig. Everyone should be cross-trained in critical functions as you cannot anticipate in advance who will be available to respond to an emergency and in what capacity. Finally, the federal government abdicated responsibility for appropriate intervention, which decision is all the more baffling given that BP executives have given us no reason for confidence in their judgment calls. It is just a horrifying story all round.

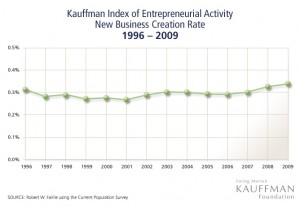

Record Business Start-ups in 2009

Monday, May 24th, 2010The Kauffman Foundation reports that in 2009, U.S. new business formations reached the highest level in 14 years, even exceeding the number of startups during the peak 1999 – 2000 technology boom. In 2009, the third year of the deepest recession since the Great Depression, 100,000 Americans started businesses each month, representing a 4% increase over 2008. The Kauffman Index of Entrepreneurial Activity also finds that African Americans and older Americans were the two demographic groups with the greatest increases in business creation rates year over year. Is this trend something to celebrate? The Kauffman Foundation seems to think so, but remember, most small businesses will fail and fewer than one in five survive to reach its fifth anniversary. The trend may represent an attempt to create self-employment from those who have been laid off and are discouraged in the job market. These new entrepreneurs are taking on significant risk, such as putting equity in a business, purchasing equipment and services and possibly guaranteeing debt for a business that might not succeed. Of course, that is always the risk in entrepreneurship, but older Americans do not have a long time horizon to play catch-up on retirement savings when a business fails. Let’s reserve judgment until 2014 when we see how the Entrepreneurial Class of 2009 fares on its fifth anniversary. To see the entire study of the Kauffman Foundation, click here.

Severe Flooding in Eastern and Central Europe

Saturday, May 22nd, 2010Heavy rainfall over a period of days ruptured river bank dykes and triggered flash flooding in low lying areas of Poland, Hungary, the Czech Republic and the Slovak Republic. Strong winds accompanied the heavy rain, causing power outages and disrupting transportation. At least twelve people have been killed with thousands of homes and businesses flooded. Southern Poland was hit the hardest; experiencing the worst floods in ten years after the Vistula River burst a dyke. Government officials in Poland estimate the flood damage to be in excess of €2 billion or US$2.5 billion. Following on the worst floods in 200 years in Rhode Island and the worst floods in 500 years in Tennessee, the weather patterns of extreme frequency and severity are alarming. Make certain your flood insurance is up to date. In any given year, 30% of the properties that flood are located in regions that have never before flooded or are not located in identified flood plains. In other words, you can’t necessarily assume that your property is not at risk for its location.

Lloyds of London Fears the Perfect Storm

Friday, May 21st, 2010The chief executive of the Lloyds of London insurance market believes that the industry faces the “perfect storm” this year. In his speech to the Insurance Day London Summit, Lloyds CEO Richard Ward stated that the insurance industry is already under pressure even before the U.S. hurricane season begins June 1. The Deepwater Horizon oil spill is likely to cost the insurance industry $3.5 billion, making it the largest insured loss in the energy sector since the 1988 explosion of the Piper Alpha rig in the North Sea. The implications of the precedent are likely of serious concern to the Lloyds market, given that Piper Alpha precipitated the spiral of reinsurance losses that brought Lloyds to the brink of insolvency in 1992. Swiss Re estimates its share of the oil spill loss to be $200 million; Lloyds will issue its own estimate by month-end. As reinsurers will absorb most of the losses related to the oil spill, they will increase premiums assessed to direct insurers that will, in turn, raise insurance premiums on personal and commercial policyholders. What drives the rate hikes is not just the absolute magnitude of losses, but their occurrence in combination with low investment returns. Insurers collect premiums to cover risks and invest those premiums to generate returns from which claims will be paid. For the insurance industry, the combination of high underwriting losses (such as the oil spill, the Chilean earthquake and other disasters of 2010) with low interest rates can be fatal. This is what the Lloyds CEO meant when he referenced the “perfect storm”. Of course, what is particularly worrisome is that the insurance industry is under pressure in 2010 even before the start of the U.S. hurricane season. What does this mean for small businesses? If you can renew your coverage sooner rather than later, you might avoid rate hikes almost certain to follow later in the year.

Storm Surge Impact a Major Concern This Summer

Thursday, May 20th, 2010First Spatial, a mapping technology company, has issued a report analyzing the impacts of hurricane storm surges on U.S. cities on the Atlantic and Gulf coasts. Storm surges are walls of water created under hurricanes when high winds push the water to the edge of the storm. The surge wall rises higher as the ocean floor becomes shallower as the storm approaches the coastline. According to this report, New Orleans and Miami are most vulnerable to a Category-1 hurricane. The researchers evaluated residential valuation data against a storm surge model to determine potential losses under different scenarios. They found, for example, that a Category-4 hurricane would cause $11 billion in damages to Long Island. Of course, if commercial properties were included in the analysis, the impacts would be much greater. What the report does not measure are the human losses; according to the National Oceanic and Atmospheric Administration, flooding induced by storm surges has killed more people in the U.S. than any other consequence of hurricanes, such as high winds or fresh-water flooding. For this reason, the NOAA is working to improve its forecasts of storm surge warnings. Given that AccuWeather forecasts an “extreme” hurricane season for 2010, these advisories are critical.

Ohio Looks at Workers Comp

Wednesday, May 19th, 2010A bill has just been introduced in the Ohio State Legislature that would require workers injured on the job to submit proof of identity to determine their legal status before workers compensation benefits would be paid. Those undocumented workers no longer eligible to receive benefits could sue their employers to pay for medical rehabilitation for injuries sustained on the job, provided that they could prove that the employer hired them knowing that they were not legally authorized to work in the U.S. Currently, Florida, Idaho, Michigan and Wyoming prohibit illegal aliens from receiving workers compensation benefits. Advocates for illegal immigrants point out that these workers are over-represented in high-risk occupations, such as in the construction and meat and poultry packing industries, are without health insurance and receive little safety training. Exclusion from the workers compensation system may incent them to seek higher-cost treatment in emergency rooms. Employers are incented to use low-cost, illegal labor, as it would not count in the determination of workers compensation premiums. Issues such as this one illustrate why we need a comprehensive approach to dealing with illegal immigrants. The status quo simply allows noncompliant businesses to capture the benefits of low-cost labor while externalizing the associated social costs.

Improving Power Recoveries After Major Storms

Tuesday, May 18th, 2010Researchers have developed a computer model that may predict power failures prior to major storms, which insight may allow for better facilities planning for the benefit of consumers. Geography professors Seth Guikema of Johns Hopkins University and Steven Quiring of Texas A&M University examined data from five hurricanes that caused power losses, some for more than ten days: Dennis (1995), Danny (1997), Georges (1998), Ivan (2004) and Katrina (2005). They considered the locations of the power failures, the configurations of the power systems and the specific characteristics of the individual hurricanes, such as wind speeds. They believe that the data they have collected result in a model to improve the accuracy of predicted power failures, allowing utility companies to better utilize resources in advance of a storm with crews assigned to the areas likely to be affected. More accurate forecasts can reduce the millions of dollars utility companies pay in power restoration to the benefit of the hundreds of thousands of affected residents and businesses. With hurricane season just around the corner, small businesses located in the Atlantic and Gulf Coast states should ask their utility providers for specific details of their contingency plans for major storms. Make sure that your electricity and gas providers are aware of this research, it could make a difference to your business.

California Considers Auto Insurance Rates

Monday, May 17th, 2010While the banking sector dominates the national news headlines, the insurance industry is capturing attention at the local level. Yesterday, I blogged about Arizona’s decision to privatize its workers compensation fund. Today, let’s turn our attention to California where residents are debating the merits of Proposition 17, a measure designed to lower auto insurance rates and increase competition. Opponents of the measure, which appears on the June 8 ballot, say it will do just the opposite. The existing law in California allows drivers with good safety records and continuous insurance coverage to benefit from premiums discounts. Proposition 17 allows drivers to carry those discounts over to new insurance providers. The measure is backed by major insurance players, which may see an opportunity to capture market share. I see no reason why an insurance company cannot match a discount for a driver with a good safety record to win the business, without putting the measure to a public referendum. Market practice, not political fiat, should govern rates.