Over eight years of negotiations over the fate of the former Deutsche Bank Building may be coming to an end. The building, located at 130 Liberty Street, faces the World Trade Center and became a serious environmental hazard on September 11, 2001. Now the Lower Manhattan Development Corp. (LMDC), established to oversee the reconstruction of the community following the terrorist attacks, may be close to resolving the expense of the building’s decontamination. Since 9-11, the building has been covered by a dark tarp to limit airborne contaminants of soot and ash released when the World Trade Center burned to the ground. Community activists opposed the proposed demolition of the building for fear of health effects to the local residents. Instead a compromise was negotiated: a staged decontamination and demolition process. But the process appeared jinxed as it dragged on for years, marred by horrific accidents and costly delays. In 2007, a fire broke out in the building, claiming the lives of two firemen. The building contractor admitted to wrongdoing in respect of its practices. The delays caused the costs of building decontamination to reach in excess of $200 million, provoking protest from the building’s insurers. The insurance companies have an excess of loss agreement in place to cover the decontamination costs. But the manner in which those costs have escalated necessarily gives rise to disputes over payments due. The LMDC and the insurance companies are reportedly close to concluding a financial settlement. Now comes the next round of disputes: what to do with any payments in excess of building remediation costs? Various groups are lobbying for their share of the spoils. Imagine what misery continues to exist for the residents and small businesses of disaster-ravaged communities who just want to put the tragedy behind them and get on with their lives.

Archive for January, 2010

At Last?

Tuesday, January 26th, 2010Fragile Urban Infrastructures Require Flexible Response

Thursday, January 7th, 2010This is the time of year when I most miss living in Switzerland. My friend took the attached photograph of blizzard conditions in London for which the city is never prepared. Public transportation and all other essential services grind to a halt with such weather. Businesses need to plan for workers to telecommute from home. This necessarily requires explicit procedures for the use of company-issued laptops. Laptops should be used for business purposes only, as surfing popular consumer sites through the Internet browser expose the business to more risk of malware and other intrusions. Exercise special care for file storage, as you want to discourage saving files to the hard disks of laptops where they can be lost or damaged. The use of a virtual private network will allow secure access to company computing facility and proper backup of files across the network. When the forecast is unclear, encourage telecommuting to keep employees from traveling on unsafe roads. Advance planning will limit the impact weather-related disruptions on your business.

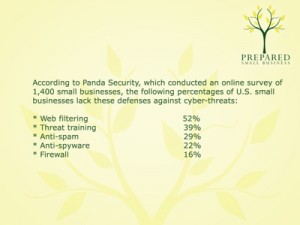

Small Business Banking Less Secure Online Than Personal Banking

Tuesday, January 5th, 2010The American Bankers Association and the Federal Bureau of Investigation have responded to increasing cyber-robberies targeting small businesses. They issued an advisory to use a separate computer with no other functionality except for online banking. The FBI is investigating suspicious patterns of “banking Trojans” or malware on computers that enable access to online bank accounts. These Trojans are becoming increasingly sophisticated in their manipulation of technologies for clearinghouse and wire transfers. The FBI has investigated more than 200 incidents in which cyber-robbers effected fraudulent transfers of banking funds involving more than $100 million for which the victims were mostly small businesses. Sadly, business banking accounts do not benefit from the same protections afforded to individual consumer accounts, which require banks to fully reimburse account holders who immediately report fraudulent account activity. In the case of banking fraud perpetrated on a business account, the bank can deny its liability for the failure of the business customer to properly protect its computer. We should all request clarification from our banks on their fraud protection policies. Meanwhile, protect your business by conducting banking activity from a stand-alone computer that is never used for e-mail or web browsing, making it less vulnerable to infection by malware.

Stress in the Florida Insurance Market

Sunday, January 3rd, 2010State Farm Florida has entered into a consent order with its state insurance regulator that will help the company to stabilize its financial condition by reducing its exposure to catastrophes and raising premiums. The Florida property insurance market is under enormous pressure; 102 of the 210 private property insurers operating in the state are losing money. Three went out of business in the last year. The consent order allows State Farm to non-renew no more than 125,000 of its 810,416 residential property insurance policies in Florida. Those policyholders designated for non-renewal will have at least six months’ notice and will be offered other insurance options. The new rates will go into effect as the remaining policies are renewed. State Farm Florida will remain the largest private insurer of property in the state and was granted a 14.8% rate increase on all homeowners’ policies. Policyholders need not take action at this time, but those of us who have looked at the declining property market in Florida need to take into consideration the rising costs of homeownership there.

Sleepless in Chicago

Saturday, January 2nd, 2010Who goes to Chicago in the fall and winter months? Well, I do. I had the privilege to speak at the annual small business banking conference sponsored by Source Media, publisher of American Banker. I appreciate the opportunity to hear the banker’s perspectives on declining commercial and small business loan volumes. One theme that emerged in the discussions was the opportunity afforded by the recession to improve underwriting discipline while rebuilding banks’ capital bases. While that is hardly the news we want to hear, to be fair to the bankers, regulators have put them in an impossible position. Privately, bank supervisors hector management about extending credit while publicly, politicians pillory them for their failure to do so. It is a no win situation for the banks. Economics, not politics, should drive small business lending decisions. I took advantage of my stay to meet with Linda L. Darragh, Clinical Associate Professor of Entrepreneurship at University of Chicago’s Booth School of Business. A passionate advocate for entrepreneurship, she initiated a venture fund and served on the Mayor of Chicago’s high technology task force. I took full advantage of her insight and suggestions as to how to improve my own business operations. So that encouragement compensated for the gloomy credit outlook! Actually, my visit to Chicago was a joy all round and I look forward to returning.

Happy New Year

Friday, January 1st, 2010As we look forward to 2010, I have prepared New Year’s resolutions for my business. I am re-framing the recession as an opportunity. In past years, even in the frothy bull market, I spent too much time chasing clients for payments past due. I hated being a bill collector! It is not just a drain on your time, but a drain on your energy. Now I am using the difficulty accessing capital to explain to current and future clients why I require a more significant retainer before commencing work. Not everyone will accept those terms, of course, but those who do are serious and those who don’t may be opportunities that I should not pursue anyway. The end result may be a smarter, but smaller business, but one that will better support my lifestyle objectives. Large corporations typically refer to their procurement policies to explain why they cannot pay retainers. After all, they say, we pay everyone net 45 days. But with widespread knowledge about the access to capital, it is easier to explain why that no longer works. It is hard to justify drawing down on your working capital to perform work and hope for timely payment. Assuming of course that your client doesn’t go into bankruptcy. The new environment may offer some peverse upside and my New Year’s resolution is to find it.